News Excerpt:

The Union Finance Minister has proposed significant reductions in customs duties on precious metals, providing relief to buyers.

Proposed Reductions:

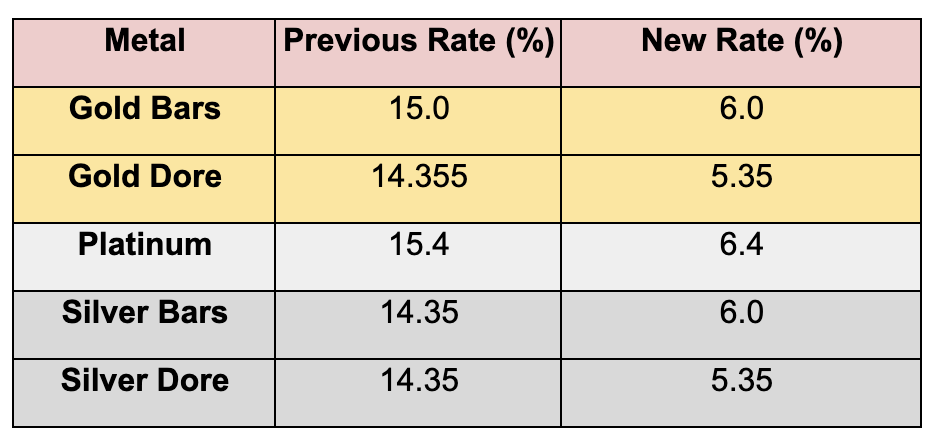

- Additionally, the levy on platinum, palladium, osmium, ruthenium, and iridium decreased from 15.4% to 6.4%.

- Previously, the duty on gold and silver was 15%, including a 10% basic customs duty and a 5% Agricultural Infrastructure Development Cess. The new structure imposes a 5% basic customs duty and a 1% Agriculture Infrastructure & Development Cess (AIDC) on gold and silver imports, lowering the total import duty to 6%.

- This reduction benefits organized retail jewellers, consumers, and the government, making it a positive development for all parties involved.

Objective of the proposal:

- The government reduced customs duties on various products, including gold, silver, and critical minerals, to lower input costs, enhance value addition, boost export competitiveness, cut smuggling, and stimulate domestic manufacturing.

- However, it is estimated to result in an annual revenue loss of ₹28,000 crore based on FY24 import levels.

- Additionally, the Finance Minister announced measures to support the diamond cutting and polishing industry by proposing safe-harbor rates for foreign mining companies selling raw diamonds in India.

- This initiative aims to bolster India's position as a world leader in the diamond industry, which employs a large number of skilled workers.

Safe Harbour Rate and Its Impact on India's Diamond Industry

- The concept of a "safe harbor rate" involves setting a predetermined tax rate for transactions, providing certainty and simplicity in tax compliance.

- This approach is particularly relevant in India's diamond cutting and polishing industry, where a large volume of rough diamonds is imported for processing.

- Without safe harbor rates, tax authorities would closely examine the transaction to ensure that the pricing is fair and not manipulated to avoid taxes.

- This scrutiny can lead to lengthy audits and potential disputes over the fair market value of the diamonds.

- To streamline this process, the government introduces a safe harbor rate for such transactions.

- For instance, it sets a predetermined tax rate, say 10% (hypothetical) on the value of raw diamonds sold by foreign companies to Indian companies.

- So, if any company sells diamonds worth ₹10 lakh to another company , they would pay ₹1 lakh in taxes under this rate.

- For companies it provides clarity and predictability, reducing the risk of disputes and lengthy audits.

- For India, it encourages more raw diamond imports, supports local craftsmen, and fosters a stable business environment.

Conclusion:

The Gem & Jewellery Export Promotion Council (GJEPC) welcomed the budget proposals, viewing them as transformative for the indigenous gem and jewelry industry and a step towards establishing India as a global diamond trading hub.

The changes, including the removal of the equalization levy and the introduction of safe-harbor tax provisions for rough diamond trading, are expected to promote growth in the diamond sector, potentially making India the largest center for rough diamond trading.

|

The Gem & Jewellery Export Promotion Council

|