News Excerpt:

The Union Minister of Finance and Corporate Affairs presented the Union Budget 2024-25 in Parliament.

More about News:

- Altering the structure for taxation of income under the new regime, the Finance Minister revised the tax slabs whilst retaining the erstwhile corresponding tax rates other than increasing the standard deductions.

Key points regarding taxation part of Budget:

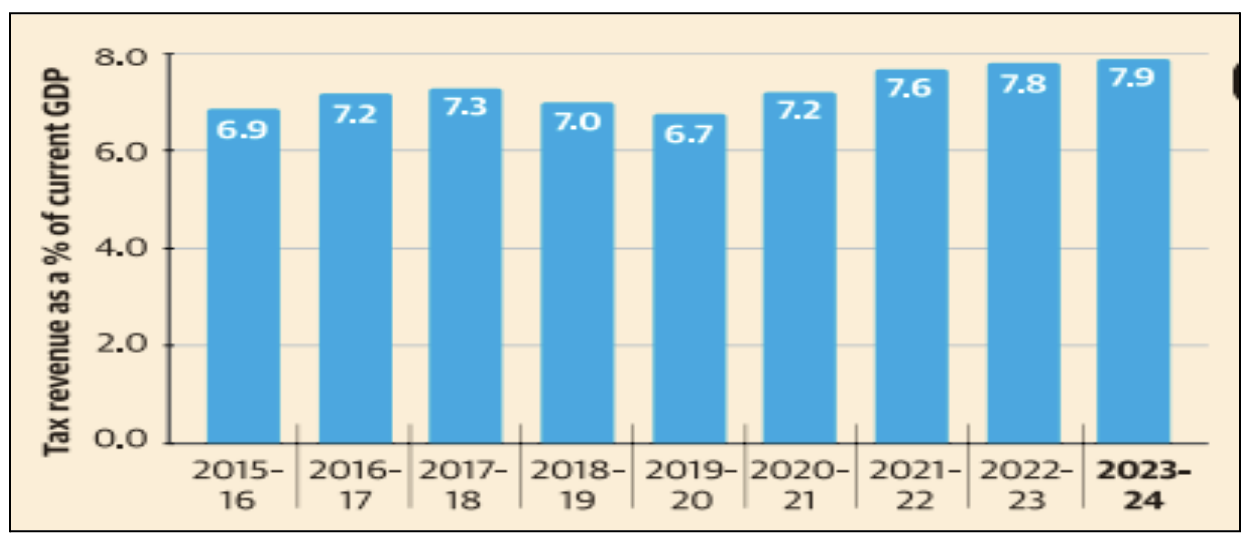

- The Centre's net tax revenue (not including the transfer to States) as a share of GDP at current prices has stagnated. It continues to remain below the 8% mark as shown in the graph.

Indirect Taxes:

- GST:

-

- Buoyed by GST’s success, tax structure to be simplified and rationalized to expand GST to remaining sectors.

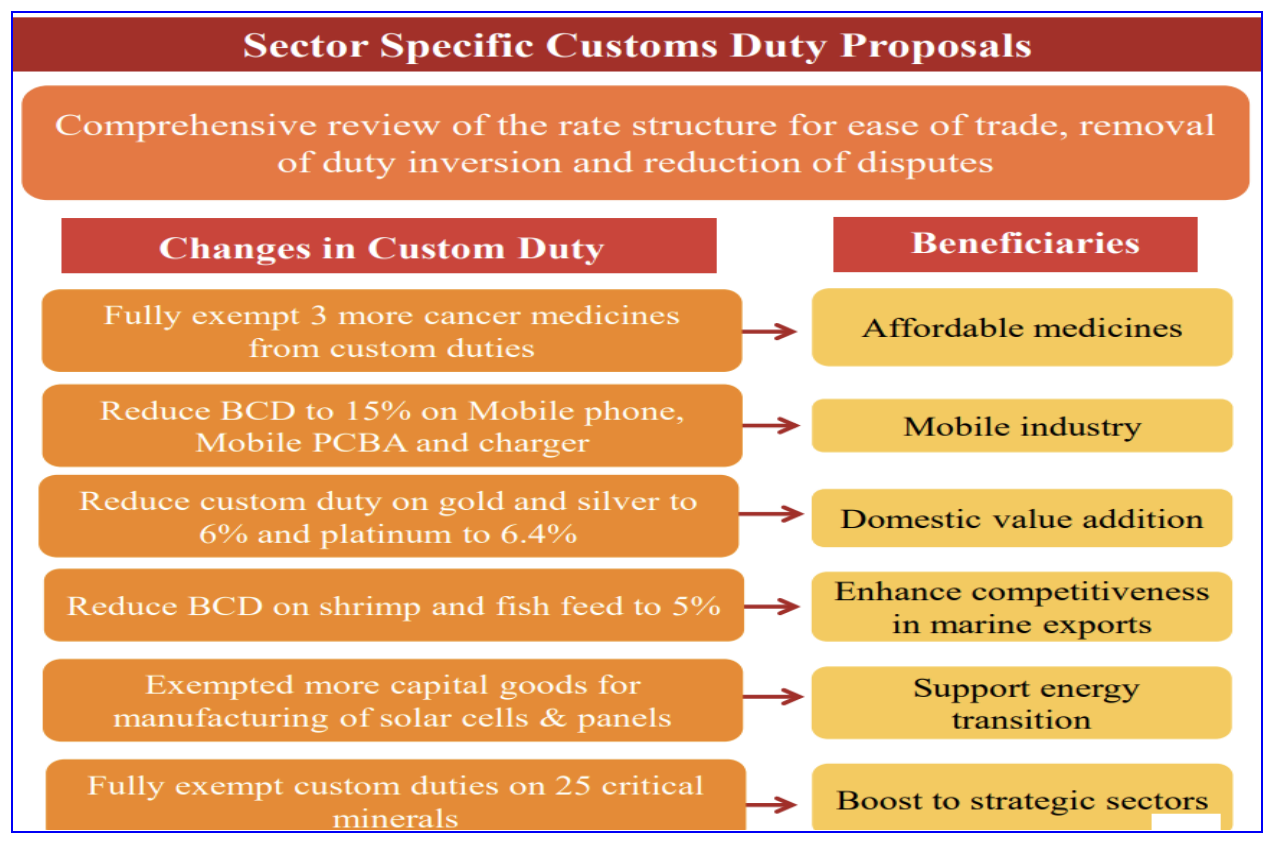

- Sector specific customs duty proposals:

-

- Other Metals:

- BCD removed on ferro nickel and blister copper.

- BCD removed on ferrous scrap and nickel cathode.

- Concessional BCD of 2.5 per cent on copper scrap.

-

- Electronics:

- BCD removed, subject to conditions, on oxygen free copper for manufacture of resistors.

-

- Chemicals and Petrochemicals:

- BCD on ammonium nitrate increased from 7.5 to 10 per cent.

-

- Plastics:

- BCD on PVC flex banners increased from 10 to 25 per cent.

-

- Telecommunication Equipment:

- BCD increased from 10 to 15 per cent on PCBA of specified telecom equipment.

-

- Trade facilitation:

- For promotion of domestic aviation and boat & ship MRO, the time period for export of goods imported for repairs extended from six months to one year.

- Time-limit for re-import of goods for repairs under warranty extended from three to five years.

-

- Solar Energy:

- Capital goods for use in manufacture of solar cells and panels exempted from customs duty.

-

- Marine products:

- BCD on certain broodstock, polychaete worms, shrimp and fish feed reduced to 5 per cent.

- Various inputs for manufacture of shrimp and fish feed are exempted from customs duty.

-

- Leather and Textile:

-

-

- BCD reduced on real down filling material from duck or goose.

- BCD reduced, subject to conditions, on methylene diphenyl diisocyanate (MDI) for manufacture of spandex yarn from 7.5 to 5 per cent.

-

Direct Taxes:

- Efforts to simplify taxes, improve taxpayer services, provide tax certainty and reduce litigation to be continued.

- Enhance revenues for funding development and welfare schemes of the government.

- 58 percent of corporate tax from simplified tax regime in FY23, more than two-thirds taxpayers availed simplified tax regime for personal income tax in FY 24.

- Simplification for Charities and of TDS:

-

- Two tax exemption regimes for charities to be merged into one.

- The 5 per cent TDS rate on many payments merged into the 2 percent TDS rate.

- 20 percent TDS rate on repurchase of units by mutual funds or UTI withdrawn.

- TDS rate on e-commerce operators reduced from one to 0.1 per cent.

- Delay for payment of TDS up to due date of filing statement decriminalized.

- Simplification of Reassessment:

-

- Assessment can be reopened beyond three years up to five years from the end of Assessment Year only if the escaped income is ₹ 50 lakh or more.

- In search cases, the time limit is reduced from ten to six years before the year of search.

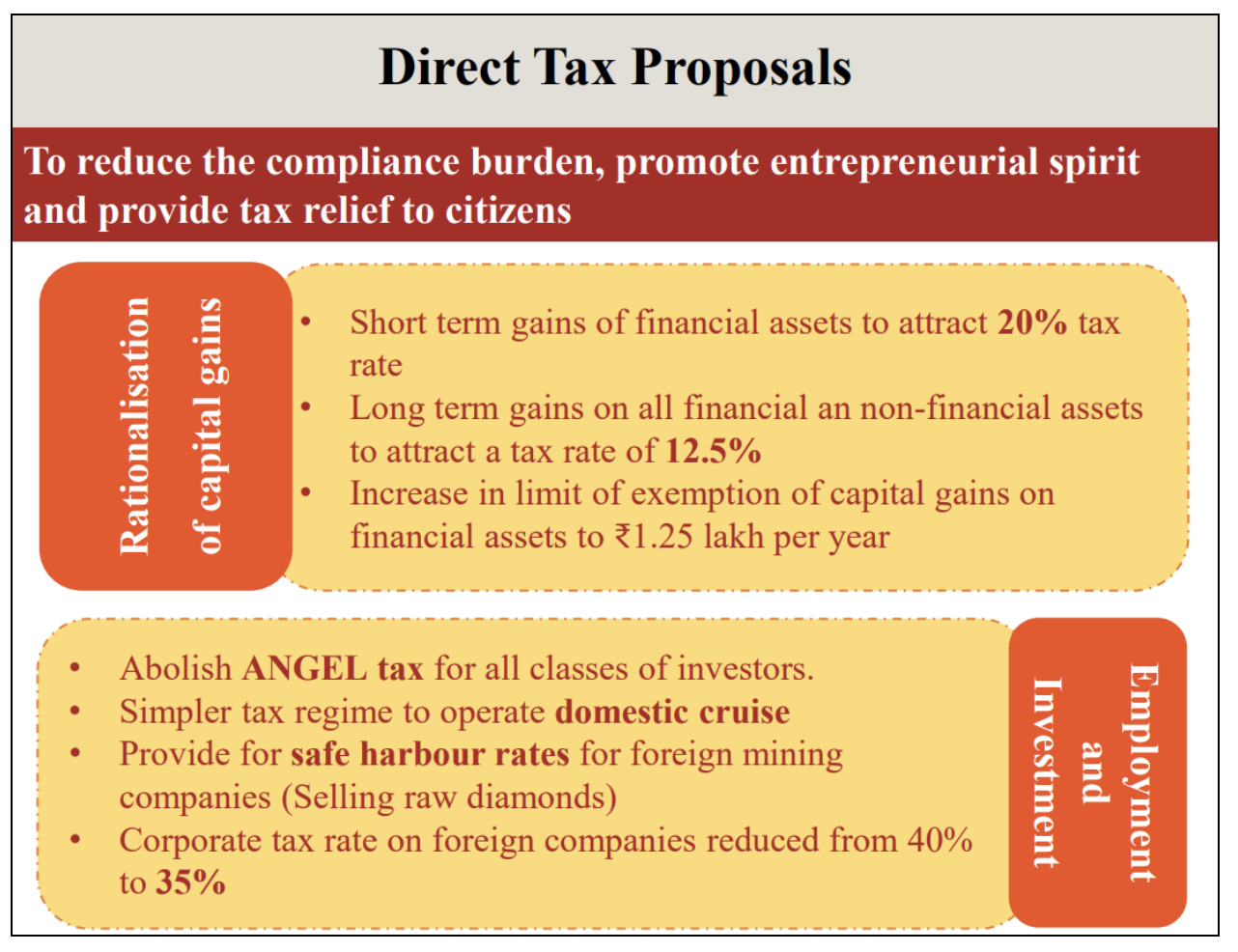

- Simplification and Rationalisation of Capital Gains:

-

- Listed financial assets held for more than a year would be classified as long term, while unlisted financial assets and all non-financial assets would have to be held for at least two years to be classified as long term.

- Unlisted bonds and debentures, debt mutual funds and market-linked debentures, irrespective of the holding period, would attract tax on capital gains at applicable rates.

- Short term gains on certain financial assets to attract a tax rate of 20 per cent.

- Long term gains on all financial and non-financial assets to attract a tax rate of 12.5 per cent.

- Exemption limit of capital gains on certain financial assets increased to ₹ 1.25 lakh per year.

- Listed financial assets held for more than a year would be classified as long term, while unlisted financial assets and all non-financial assets would have to be held for at least two years to be classified as long term.

- Taxpayer Services:

-

- All remaining services of Customs and Income Tax including rectification and order giving effect to appellate orders to be digitalized over the next two years.

- Litigation and Appeals:

-

- ‘Vivad Se Vishwas Scheme, 2024’ for resolution of income tax disputes pending in appeal.

- Monetary limits for filing direct taxes, excise and service tax related appeals in Tax Tribunals, High Courts and Supreme Court increased to ₹60 lakh, ₹2 crore and ₹5 crore respectively.

- Safe harbor rules expanded to reduce litigation and provide certainty in international taxation.

- Employment and Investment:

-

- Angel tax for all classes of investors abolished to bolster the start-up ecosystem.

- Simpler tax regime for foreign shipping companies operating domestic cruises to promote cruise tourism in India.

- Safe harbor rates for foreign mining companies selling raw diamonds in the country.

- Corporate tax rate on foreign companies was reduced from 40 to 35 per cent.

- Deepening tax base:

-

- Security Transactions Tax on futures and options of securities increased to 0.02 per cent and 0.1 per cent respectively.

- Income received on buy back of shares in the hands of the recipient to be taxed.

- Social Security Benefits:

-

- Deduction of expenditure by employers towards NPS to be increased from 10 to 14 percent of the employee’s salary.

- Non-reporting of small movable foreign assets up to ₹20 lakh de-penalised.

- Other major proposal in Finance Bill:

- Equalization levy of 2 per cent withdrawn.

Changes in Personal Income Tax under new tax regime

- Standard deduction for salaried employees increased from ₹50,000 to ₹75,000.

- Deduction on family pension for pensioners enhanced from ₹15,000/- to ₹25,000/-

- Salaried employees in the new tax regime stand to save up to ₹ 17,500/- in income tax.

- Revised tax rate structure:

Significance of such changes in taxation:

- Removing angel tax is a very positive step to boost start-up morale.

- Additionally, simplifying rules and recognition for FDIs aims to facilitate inflow and promote the use of the Rupee for overseas investments.

- Numerous reforms in tax law operations are introduced to simplify the process for taxpayers and rationalize tax rates, ensuring the system remains straightforward and inflation is controlled.

- The market is expected to absorb a slight increase in long-term and short-term capital gains taxes from 10% and 15% to 12.5% and 20%, respectively, which will be balanced by benefits to salaries and the middle class due to lower tax burdens.

- Similarly, a modest rise in the Securities Transaction Tax (STT) on Futures and Options (F&Os) is deemed manageable.

- The government’s approach ensures balanced and inclusive development, steering India towards a future of economic resilience and equitable growth.

- The simplification of capital gains taxation and the introduction of a 20% tax on short-term gains will have multiple impacts.

- This will reduce volatility, raise tax revenue, and have long-term focus.

Conclusion:

Hence, The government’s approach ensures balanced and inclusive development, steering India towards a future of economic resilience and equitable growth.