News Excerpt:

An Indian delegation has visited Singapore to apprise the Financial Action Task Force (FATF) about steps taken to counter money laundering and terror financing over the past decade.

What are FATF Mutual Evaluations:

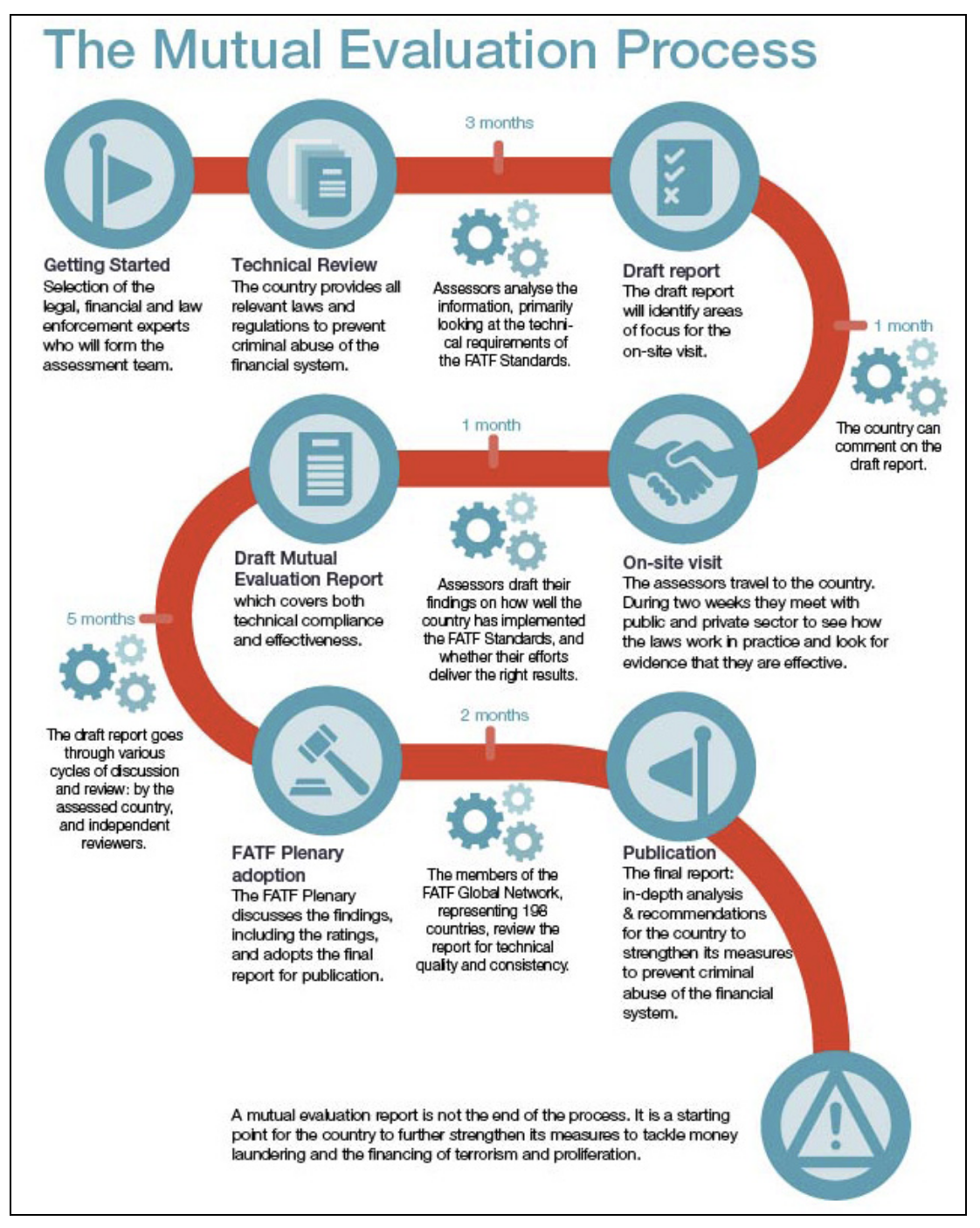

- FATF mutual evaluations are in-depth country reports analysing the implementation and effectiveness of measures to combat money laundering, terrorist and proliferation financing.

- The reports are peer reviews, where members from different countries assess another country.

- Mutual evaluations provide an in-depth description and analysis of a country’s anti-money laundering and counter-terrorist financing system, as well as focused recommendations to further strengthen its system.

Process of mutual evaluation:

- During a mutual evaluation, the assessed country must demonstrate that it has an effective framework to protect the financial system from abuse.

Mutual Evaluations have two main components, effectiveness and technical compliance.

- The most important part of a mutual evaluation is a country’s effectiveness ratings.

- This is the focus of an on-site visit by a team of experts to the assessed country.

- What is expected from a country differs, depending on the money laundering, terrorist financing and other risks it is exposed to.

- The assessment of technical compliance is also an important part of a mutual evaluation.

- The assessed country must provide information on the laws, regulations and any other legal instruments it has in place to combat money laundering and the financing of terrorism and proliferation.

Mutual Evaluation of India:

- The first Mutual Evaluation of India of India was adopted on 24 June 2010.

- India was placed in the regular follow-up process for mutual evaluation purposes because of partially compliant (PC) ratings on certain core and key Recommendations.

- Since the publication of the mutual evaluation report, India has been reporting back to the FATF on a regular basis on the progress made in the implementation of its Action Plan to strengthen India’s AML/CFT System.

- India has made significant progress with regard to the implementation of this action plan.

- India has not yet been assessed in the fourth round of mutual evaluations.

- Due to the COVID-19 pandemic and the pause in the FATF's assessment process, the mutual evaluation of India will be discussed at the June 2024 Plenary of FATF.

Anti-money laundering and terrorist financing regime in India:

- The Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) regime in India is relatively young.

- The Prevention of Money Laundering Act, 2002 (PMLA) came into force in 2005 and was amended in 2009.

- The Unlawful Activities (Prevention) Act, 1967 (UAPA) was amended in 2004 to criminalise, inter alia, terrorist financing.

- The UAPA was further amended in December 2008 to broaden its scope and to bring the legislation more in line with the requirements of the United Nations Convention for the Suppression of the Financing of Terrorism (FT Convention).

|

Financial Action Task Force (FATF):

What are FATF 'grey list' and 'blacklist'?

|