GS Paper III

News Excerpt:

The Asian Development Bank’s (ADB) report titled ‘Decarbonising Global Value Chains’ reveals that India may face a 10.5% value-added tax (VAT) on production if the European Union's Carbon Border Adjustment Mechanism (CBAM) is implemented.

Summary of the report:

- CBAM's Impact on Economy: The report notes that CBAM’s impact on the economy depends a great deal on the carbon intensity of production in products covered by the CBAM.

- Factors Driving Carbon Intensity: The carbon intensity is driven by various factors, including the energy mix in production and the production technology in different economies and regions.

- Emissions Intensities in Developing Asia and Eastern Europe: Regions in developing Asia and Eastern Europe often have some of the highest emissions intensities, given different production techniques and heavy reliance on coal as a source of energy across much of developing Asia.

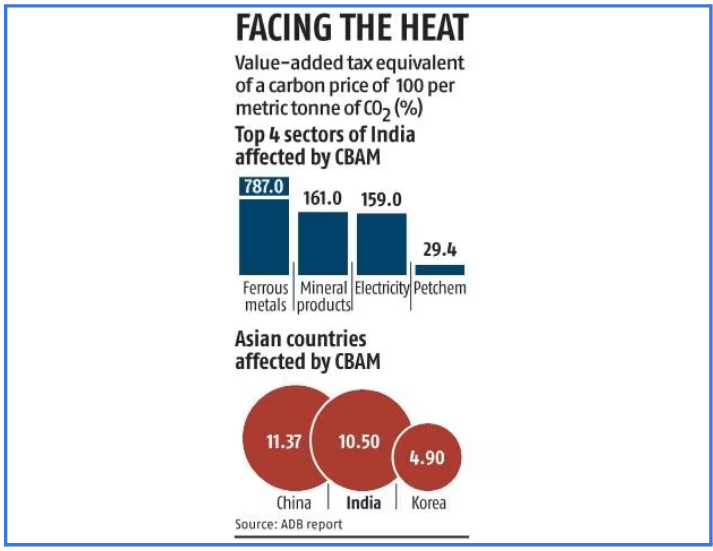

- Thus, under the assumption of a carbon price of €100 per metric tonne of CO2, current CO2 intensities in developing Asia would be the equivalent of a value-added tax of between 3 % and 12 % when considering the aggregate economy, with the rates being relatively high for India, China, and central and west Asia.

- Correspondingly, China and South Korea are expected to face tariff equivalent of 11.4 % VAT and 4.88 % VAT, respectively.

- Impact on Specific Sectors in India: In India, sectors like ferrous metals (787%) are expected to be worst impacted, followed by mineral products (161%), electricity (159.7%), petrochemicals (29.4%) and non-ferrous metals (23%).

- Limited Impact on CBAM Exports from Developing Asia: In only a couple of cases (India and Korea) does the EU account for more than 10% of core CBAM exports from developing Asia, suggesting that CBAM’s impact on production in developing Asia may be limited.

- Effects of Extending CBAM to Developing Asia: China and India are strongly affected by extending CBAM to developing Asia, likely reflecting the costs of an EU Emissions Trading System (ETS) in the context of relatively carbon-intensive production in sectors covered.

- Negative Spillover Effects on Asian Sub-regions: While the ETS can directly impact other Asian sub-regions, lowering GDP, the large negative effects in India and the PRC also have negative spillover effects on other Asian sub-regions. These spillover effects may partially explain the relatively large reductions in GDP in East Asia and Southeast Asia.

Click for more details on EU's CBAM, ESG norms