News Excerpt:

Recognising India as a “leader” in the digital public infrastructure (DPI) sector, a G20 task-force has said that if the country wishes to retain its “leadership” role, it has to take on added responsibility so that these digital solutions can reach countries around the world, especially the Global South.

About the Task Force:

- The task force is named, ‘India's G20 Task Force on Digital Public Infrastructure for Economic Transformation, Financial Inclusion and Development’.

- The Task force was established in January 2023 to oversee and facilitate achieving India's G20 Presidency agenda and priorities on Digital Public Infrastructure (DPI) and Financial Inclusion.

- The Task Force looked at ways G20 member countries can boost productivity by adopting digital technology and DPI across sectors as well as help the government's digital economy policies and regulations.

- Co-Chairs of the Task Force are:

- Amitabh Kant (G20 Sherpa of India)

- Nandan Nilekani (Co-founder and Chairman of Infosys and Founding Chairman of UIDAI (Aadhaar))

Report of India’s G20 Task Force on DPI:

- The final ‘Report of India’s G20 Task Force on Digital Public Infrastructure’ by ‘India’s G20 Task Force on Digital Public Infrastructure for Economic Transformation, Financial Inclusion and Development’ was released in New Delhi.

The report is divided into three main parts:

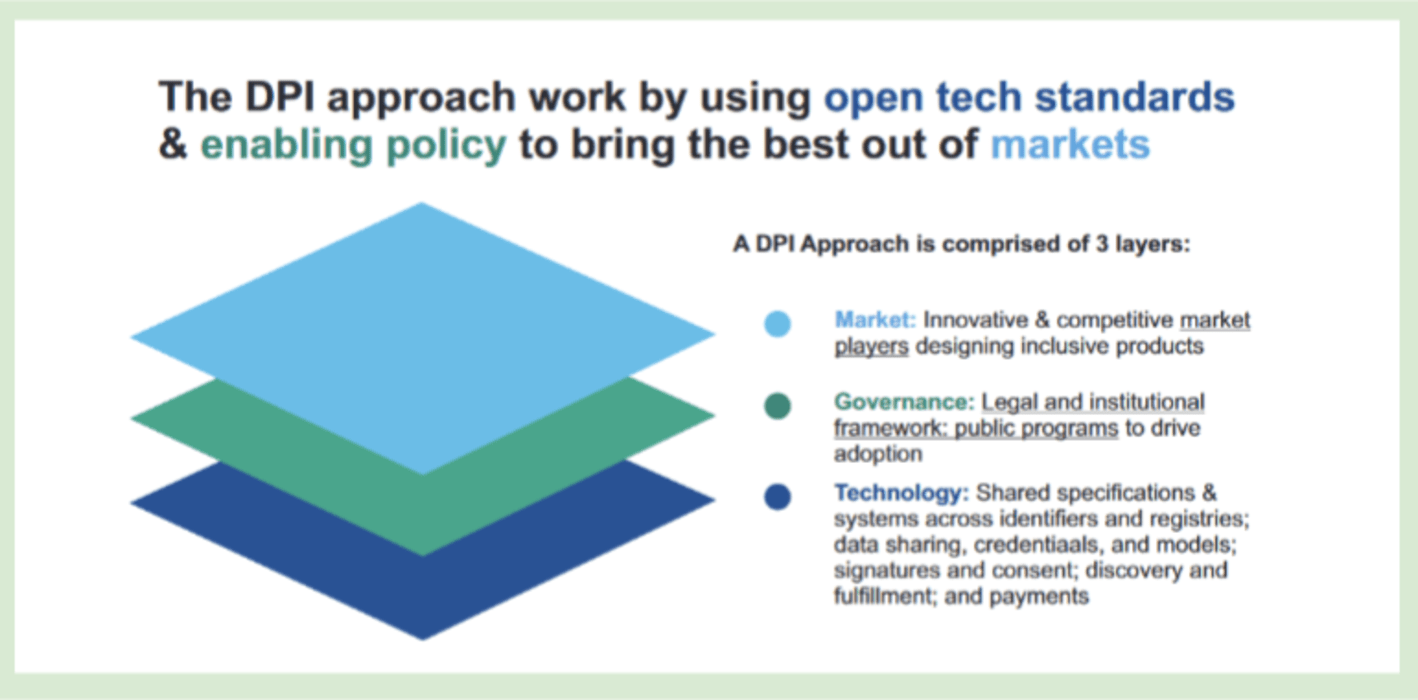

- Part 1: Introduces the DPI Approach as a transformative paradigm for addressing global challenges through innovative technological solutions.

- Part 2: Examines India's DPI agenda during its 2023 G20 Presidency, focusing on initiatives within the Global Partnership for Financial Inclusion (GPFI) and Digital Economy Working Group (DEWG).

- Part 3: Presents a forward-looking strategy outlining a strategic blueprint for elevating DPI across various sectors, as well as on a global scale through a range of its policy recommendations.

Key Highlights of the Report:

- The report emphasizes the need to identify an existing global body with a multinational presence to foster DPI ecosystems, particularly in Global South countries.

- It recognizes that many countries are exploring ways to develop national digital infrastructure to:

- Accelerate economic progress

- Drastically improve public services

- Build trust between people and institutions

- Enhance transparency

- Reduce distance between citizens and services

- The report aims to guide the future development and implementation of DPI approaches worldwide, with a particular focus on the Global South.

Global Responsibility of India in DPI:

- India needs to identify an existing body to harness the DPI ecosystem across various regions and countries, especially in the Global South.

- This body should be of global standard with multinational presence, capable of working on policy dimensions, formulation, and implementation of strategies with appropriate technical and academic expertise.

Globalization of UPI:

- The Reserve Bank of India is actively engaging with various Indian Missions abroad to globalize UPI payment rails.

- The National Payment Corporation of India's (NPCI) international arm has reached out to over 80 countries for "UPI globalization" and has executed agreements with more than 20 payment partners covering over 30 countries.

AI Integration with DPI:

- The report suggests integrating artificial intelligence (AI) with DPIs to amplify their capabilities. However, it cautions that such integration should be done with guardrails of ethical use of AI and data privacy. The report proposes a DPI approach to AI growth, including:

- Publication of open datasets via open API to train AI/ML models

- Creation of reusable AI toolkits

- Publication of open models to drive market innovation in AI

Innovation and Scalability:

- The report emphasizes that open-source software, AI models, standards, or content that are publicly available can be replicated, modified, and shared freely.

- This approach encourages innovation and scalability in DPI by promoting the entry of private players in the technology industry.

Overall the report will play a key role in defining the future course of DPI approach and actions for implementation around the globe, particularly in the Global South.

|

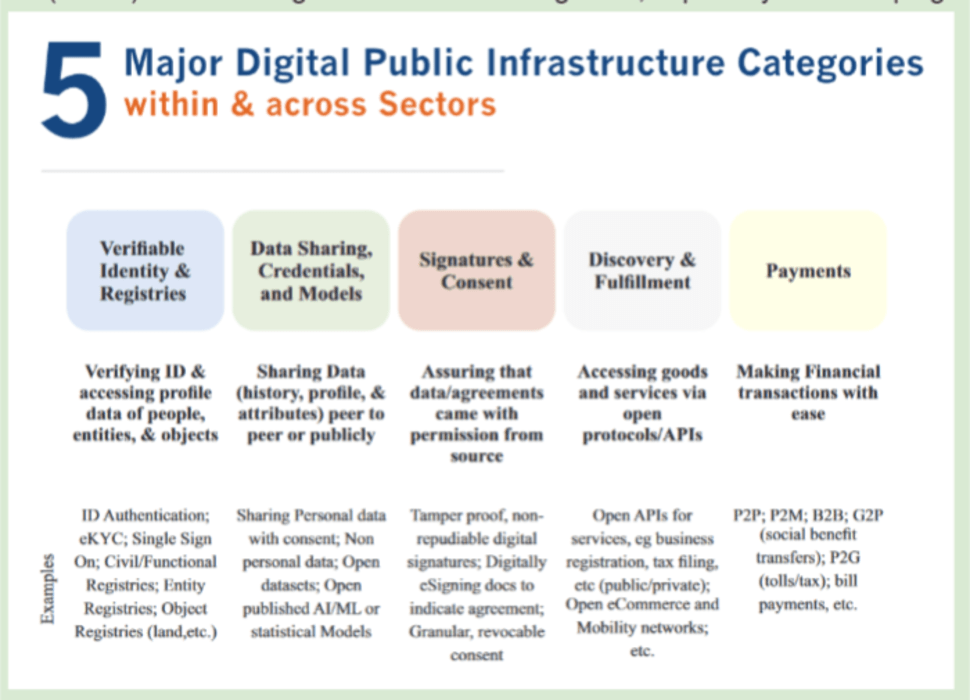

Digital Public Infrastructure (DPI): Digital Public Infrastructure (DPI) refers to a set of digital technologies, platforms, and systems that are developed and deployed to provide essential services to the public.

|