GS Paper III

News Excerpt:

The slowdown in ethanol output has consequences, putting the 20% ethanol-blended petrol (EBP) target by 2025-26 out of range and leaving India dependent on more polluting, expensive fossil fuel imports.

More about News:

- In the first half of the November 2023 - October 2024 ethanol supply year (ESY), the ethanol blending ratio averaged 12.1%, the same as the entire ESY 2022-23.

- This contrasts with the previous years, which saw a 1.9 percentage point increase in 2021-22 from 2020-21 and a 2.1 percentage point increase in 2022-23 from the preceding ESY.

Challenges in achieving Ethanol goals:

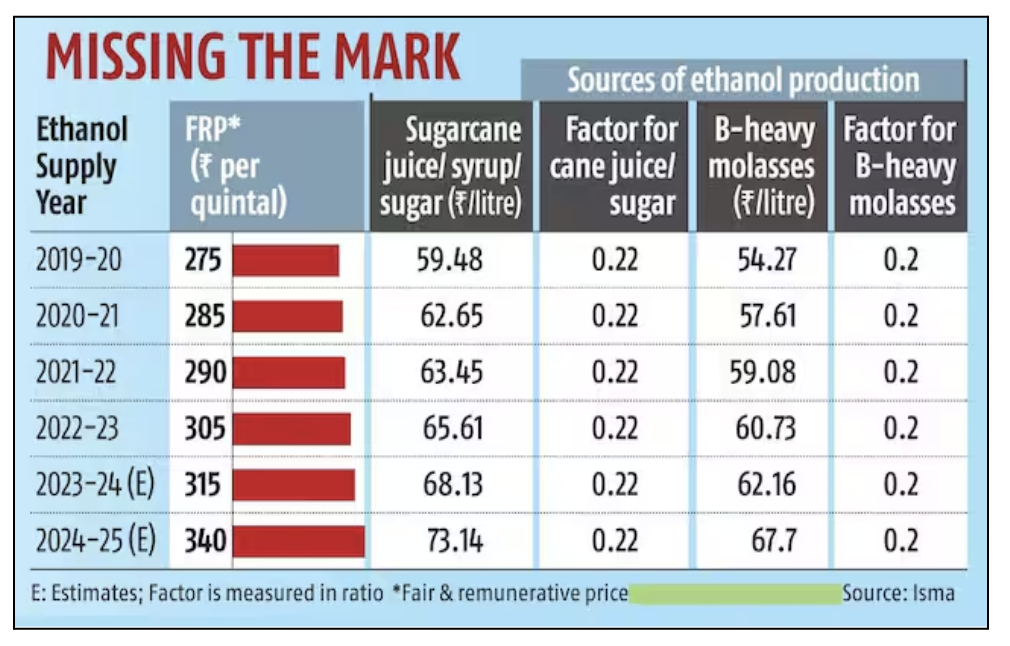

- Policy and Pricing Issues: India's ambitious plans for an agri-derived ethanol-fuelled transport sector rest on remunerative rates for ethanol and improved agricultural yields.

- The current pricing structure for ethanol made from sugarcane juice/B-heavy molasses does not adequately reflect the production costs and investments made by the sugar industry.

- The minimum support price for sugar has remained unchanged for more than five years,

- The revenue share ratio (of sugar) for Indian cane farmers is 75%, which is far higher, as opposed to 70% in other important cane-growing countries.

- Industry and Agricultural Constraints:

-

- The lack of remunerative pricing has prompted some major industry players to review their investment plans, further accentuating the shortfall in ethanol production capacity.

- The sugar industry is capable of meeting the ethanol supply for the 20% blending target, but it is contingent on stable policy, investment in sugarcane production, and farmer support.

- Government Policy Considerations and Production Targets:

-

- The government has pushed for aggressive ethanol blending targets without considering factors like weather vagaries, low crop yields, and increasing sugar consumption.

- Such an aggressive expansion of ethanol capabilities needs better agricultural management.

- India requires 29 million tonnes (mt) of sugar annually, which is increasing by 1.5–2% per year.

- A 20% blending target requires close to 10 bl of ethanol, of which 5.5 bl has to come from sugarcane; 1.32 bl will go towards alcohol for industrial and portable purposes in 2024-25,

- Weather Challenges and Prioritization

- Inclement weather and lower yields forced the government to divert more of the crop to sugar in an election season while placing restrictions on ethanol production for blending.

- The government to prioritize sugar production against ethanol production for the ethanol blending programme in a situation of limited availability of sugarcane.

Way forward:

- It’s important to fix the minimum support price and ethanol prices along with FRP every year to establish financial viability.

- Sugarcane production needs to be enhanced from the current productivity of 76 tonnes per hectare to 83 tonnes per hectare in the next five years, and the cane production area must increase from 5.7 million hectares (mha) to 6.2 mha.

|

Fair and Remunerative Price (FRP):

|