News Excerpt:

Adani Ports and Special Economic Zone Ltd. announced that it will raise ₹5,250 crore by issuing non-convertible debentures and 2.5 billion rupees through non-cumulative redeemable preference shares.

- The tenure of the instrument, date of allotment and date of maturity will be determined from time to time at the time of issue.

About:

Debentures:

- A type of loan, or a long-term debt instrument issued by a company or organisation to raise funds from the public or institutional investors.

- Some debentures have a feature of convertibility into shares (Convertible Debentures) after a certain point of time at the discretion of the owner while others don't (Non- Convertible).

Non-convertible debentures (NCDs):

- The debentures that cannot be converted into shares or equities are called non-convertible debentures (or NCDs).

- NCDs are used as tools to raise long-term funds by companies through a public issue.

- To compensate for this drawback of non-convertibility, lenders are usually given a higher rate of return compared to convertible debentures.

- Its issuance and trading usually occur in demat form only.

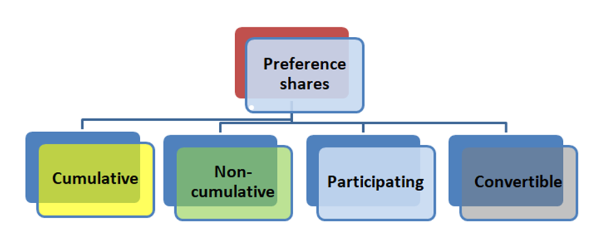

Related Terms: