News Excerpt:

The Reserve Bank of India (RBI) has added around 100 tonnes or 1 lakh kilograms of gold from the United Kingdom to its vaults in India.

- This is the most since early 1991 and the central bank intends to move more in the coming months.

History of Gold Transfer

- In 1991, the Central Government pledged the precious metal to tackle the balance of payments crisis.

- Between July 4 and 18, 1991, the RBI pledged 46.91 tonnes of gold with the Bank of England and the Bank of Japan to raise $400 million.

- In 2009, during the UPA government’s tenure, India bought 200 tonnes of gold valued at $6.7 billion from the International Monetary Fund (IMF) to diversify its assets.

Storage of Gold

- The Bank of England has traditionally served as a repository for a great deal of central banks, including India, with some of its gold reserves stored in London since before Independence.

- Domestically, gold is stored in vaults located in the RBI’s old office building on Mumbai’s Mint Road and in Nagpur.

Purchasing of Gold by RBI

- The RBI has started to accumulate gold regularly from the market since December 2017.

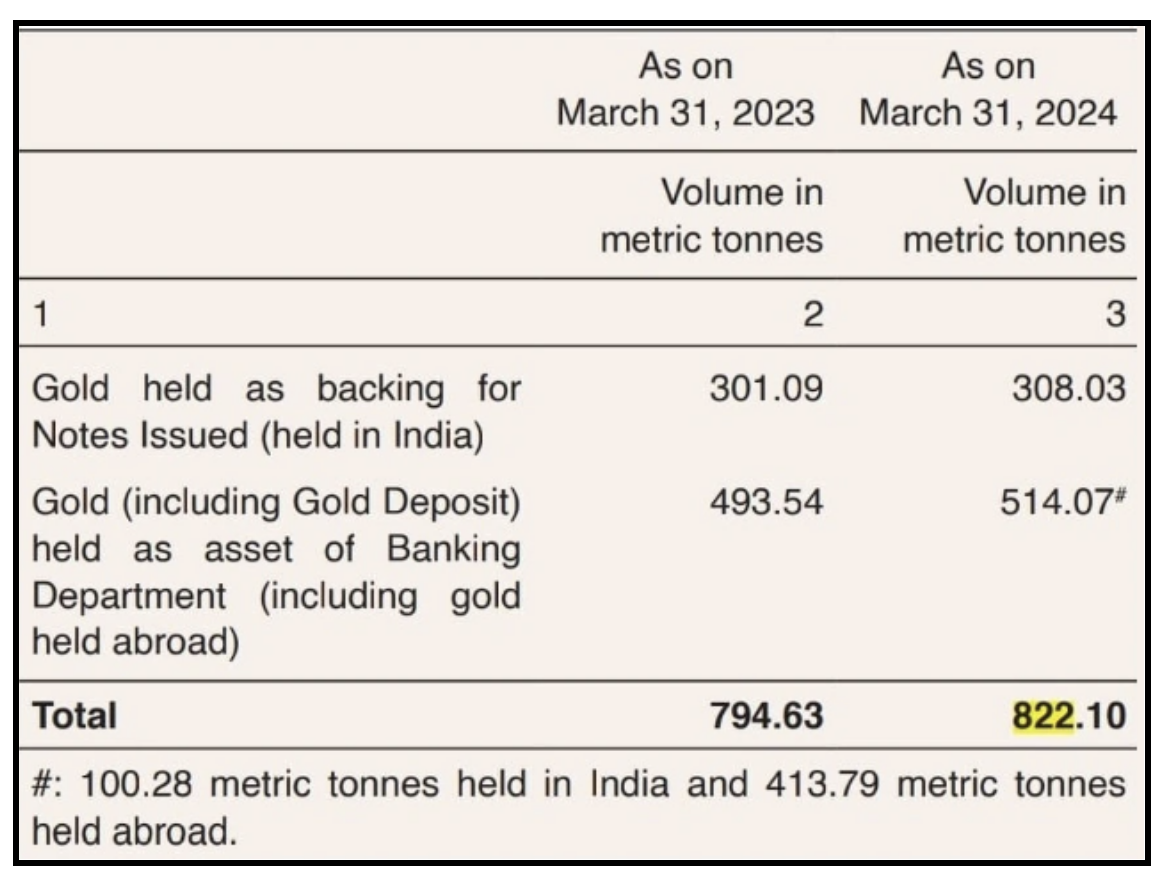

- The RBI held 822.1 tonnes of gold, with 413.8 tonnes stored overseas as of March end.

- The RBI is among the central banks that have purchased gold in recent years, and has added 27.5 tonnes in the last financial year.

Tax implication on Gold Transfer

- Initially, the RBI obtained a customs duty exemption to bring the metal into the country, with the central government "foregoing revenue" on this sovereign asset.

- However, there was no exemption from Integrated GST, which is applied to imports, since this tax is shared with the states.

Objective of Holding Gold in Forex Reserve

- The central bank's objective of holding gold in reserves is mainly to diversify its foreign currency assets base.

- It is used for hedging against inflation and foreign currency risks.

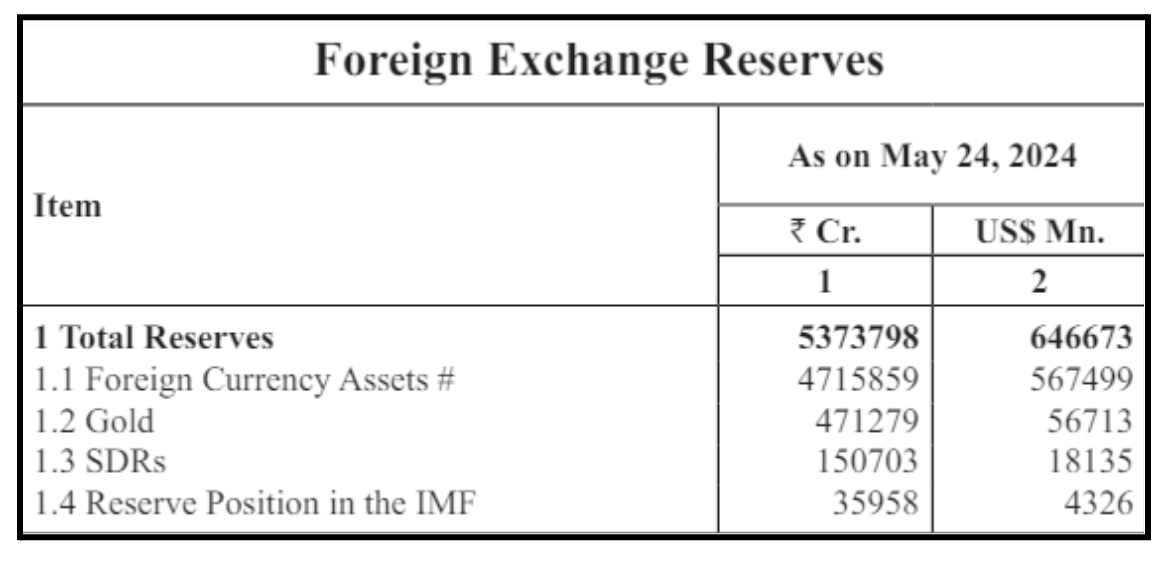

Share of Gold in Forex Reserve

- The share of gold in the country's total foreign exchange reserves increased from 7.75 percent at the end of December 2023 to about 8.7 percent as of April 2024 end.