News Excerpt:

Reserve Bank of India’s Central Board approves ₹2.11-lakh crore surplus bonanza to the government.

About the news:

- The surplus transfer in FY24 is much higher than both the budgeted (₹1.02-lakh crore, including dividends from banks and financial institutions) and street estimates of ₹1 lakh crore surplus.

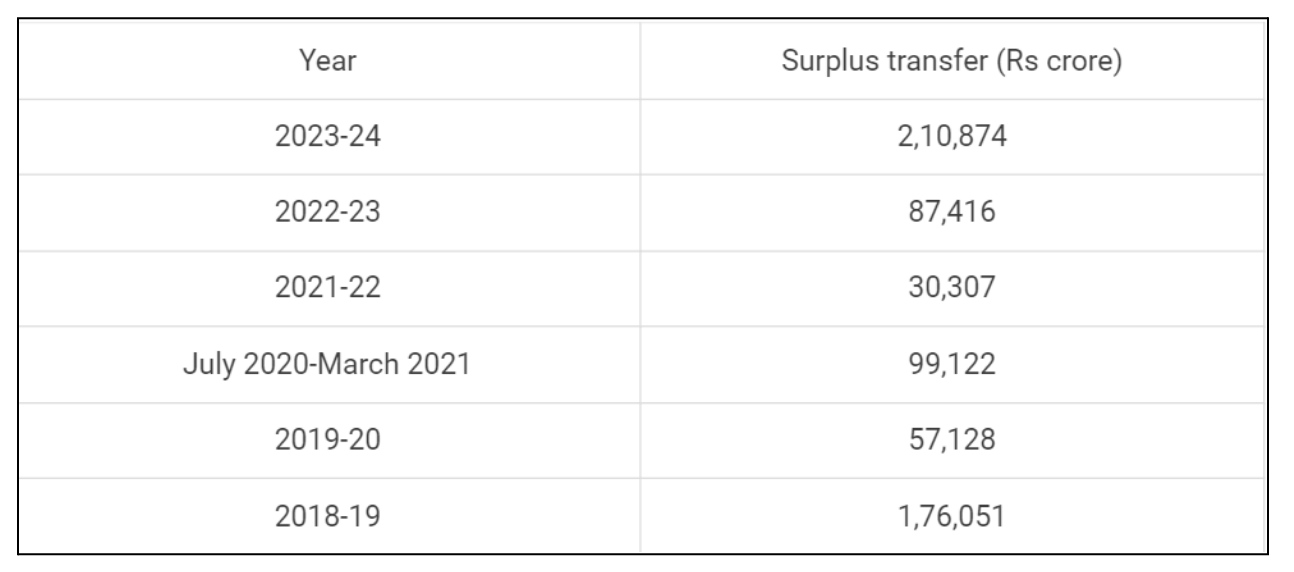

- The previous highest surplus transfer was ₹1,76,051 crore in 2018-19. The surplus transfer in FY24 is 2.41 times the previous year’s ₹87,416 crore.

- The figure is so large despite RBI setting aside the highest prescribed 6.5% of its balance sheet as its Contingent Risk Buffer, up from 6% in 2022-23 and 5.5% during the COVID years, when the buffer was reduced to lend the economy support.

- The development is an ode to the RBI managing volatility deftly while leveraging the turbulence in global markets to its advantage.

What is the Surplus?

- The RBI transfers its surplus annually to the government, the owner of the institution, after making adequate provisions for contingencies or potential losses.

- These are called transfers to the government, rather than dividends because the RBI is not a commercial organization like banks and other companies owned or controlled by the government to pay a dividend to the owner out of the profit generated. RBI transfers the surplus — excess of income over expenditure —to the government.

- Under Section 47 of the RBI Act, “after making provision for bad and doubtful debts, depreciation in assets, contributions to staff and superannuation funds and for all other matters for which provision is to be made by or under this Act or which are usually provided for by bankers, the balance of the profits shall be paid to the Central government”.

- The RBI normally pays the dividend from the surplus income it earns on investments and valuation changes on its dollar holdings and the fees it gets from printing currency, among others. The rupee's depreciation against the dollar also weighs on the surplus transfer.

- Economists have attributed the higher-than-anticipated surplus to higher interest income led by an increase in both global and domestic yields. There were also revaluation gains on forex reserves.

Impact of the surplus transfer:

This surplus transfer will have a positive impact on the government’s finances and liquidity. The options before the government are: reduce the borrowing (borrow less in FY25) and give priority to fiscal consolidation or allocate the bounty for capital spending (step up capital expenditure).

- The first option will be positive for the bond market as the demand supply will become more favourable. If the government borrows less, government security (G-Sec) yields could soften, thereby lowering its borrowing cost.

- Bond yields and prices are inversely related and move in opposite directions.

- The bumper dividend payout is also likely to ease reliance on the government’s disinvestment programme, on which progress has been slow in the last few years.

- This gives the government significant room to manage welfare spending and sustain capex spending, even if the disinvestment receipts fall short.

- The other aspect is how the RBI manages this liquidity and liquidity stance in the next policy. Suppose the stance continues to be “withdrawal of accommodation” in the next policy. In that case, the RBI may use other tools, including OMO (open market operation) sales and forex interventions to suck out the liquidity.