News Excerpt:

Sri Lanka's President announced that the country has achieved debt restructuring agreements with several countries, including India, France, Japan and China.

More about News

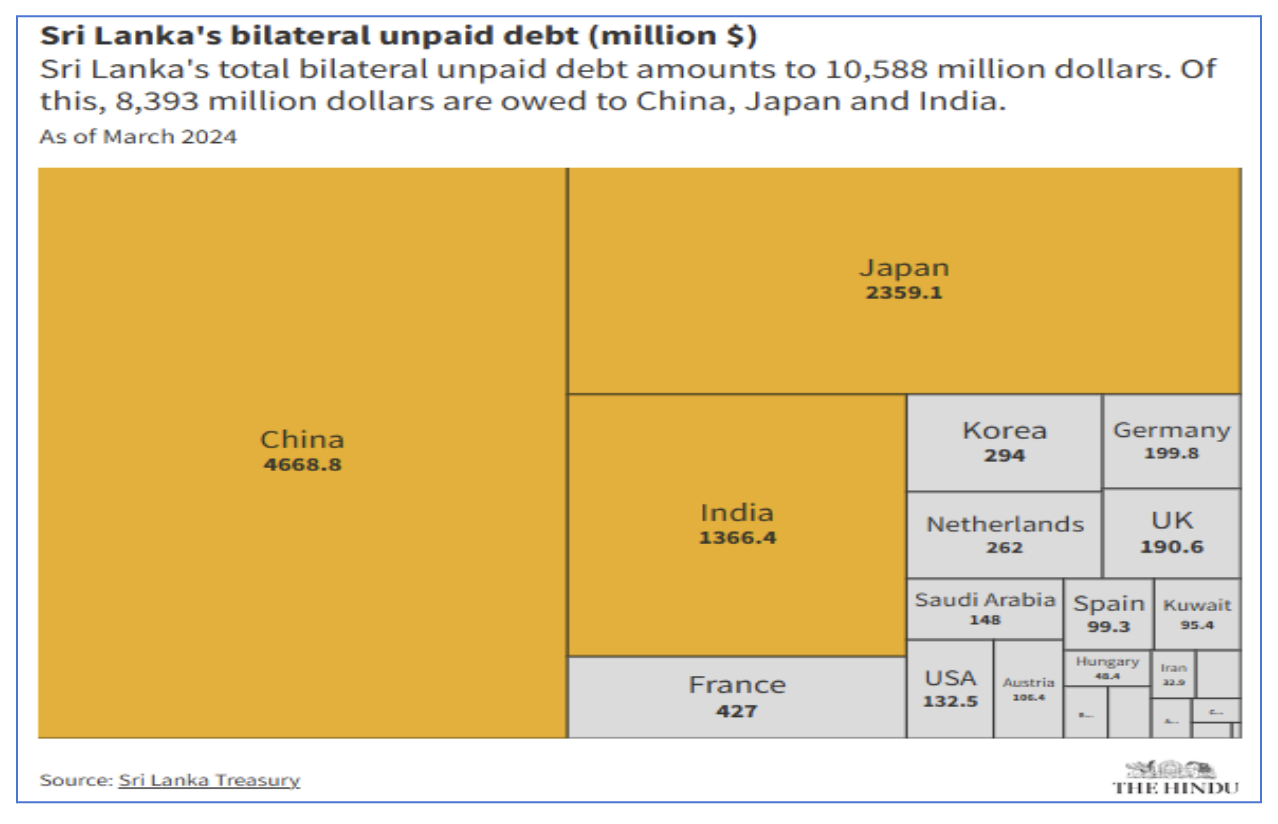

- Sri Lanka finalized a debt deal with the Official Creditor Committee (OCC) to restructure its $5.8 billion debt owed to bilateral lenders, including India.

- Sri Lanka separately signed debt treatment agreements with China Exim Bank in Beijing to restructure $4.2 billion of debt.

- This agreement provides significant debt relief, enabling Sri Lanka to allocate funds to essential public services and secure concessional financing for development needs.

About Official Creditor Committee (OCC)

- The OCC, a platform comprising 17 countries including India and members of the Paris Club such as Japan, was formed in May 2023 to streamline Sri Lanka’s debt negotiations.

- It was formed after an unprecedented financial crash in 2022 that led to the country defaulting on its external debt.

- China, Sri Lanka’s largest bilateral lender, chose not to join the OCC but participated in discussions as an observer.

History of Economic Crisis

- In April 2022, Sri Lanka declared bankruptcy and halted repayments on approximately $83 billion in domestic and foreign loans amid a severe foreign exchange crisis.

- This crisis led to a critical shortage of essential goods such as food, medicine, fuel, and cooking gas, as well as extended power outages.

- The economic turmoil was largely attributed to severe economic mismanagement and the impact of the COVID-19 pandemic, which, alongside the 2019 terrorist attacks, severely affected the crucial tourism sector.

- Additionally, the pandemic disrupted remittances from Sri Lankans abroad.

- Compounding these issues, a tax reduction in 2019 depleted the treasury just as the pandemic struck.

- The resulting plunge in foreign exchange reserves left Sri Lanka unable to afford imports or support its currency, the rupee.

IMF Bailout Program

- Sri Lanka, currently under an International Monetary Fund (IMF) bailout program, expects this debt restructuring agreement to facilitate the resumption of bilateral transactions and foreign projects that had stalled due to the default.

Impact of Agreement

- With these agreements, Sri Lanka will defer all bilateral loan payments until 2028 and will be able to repay the loans on concessional terms over an extended period until 2043.

- By 2022, Sri Lanka was obligated to repay about $6 billion annually in foreign debt, constituting roughly 9.2% of its GDP.

- The new agreement aims to reduce debt payments to less than 4.5% of GDP between 2027 and 2032.

Political Turmoil

- The economic crisis also triggered a political upheaval, leading to the resignation of then Sri Lankan President Gotabaya Rajapaksa in 2022 and the subsequent election of Wickremesinghe by Parliament.

- Under Wickremesinghe's leadership, the economic situation has improved, with severe shortages of food, fuel, and medicine largely resolved.

- However, public dissatisfaction has grown due to the government's revenue-increasing measures, including higher electricity bills and new income taxes on professionals and businesses, which are part of the conditions set by the IMF.

Conclusion:

Hence, recent development will help Sri Lanka in the tough economic phase. It will balance its status in world level