News Excerpt:

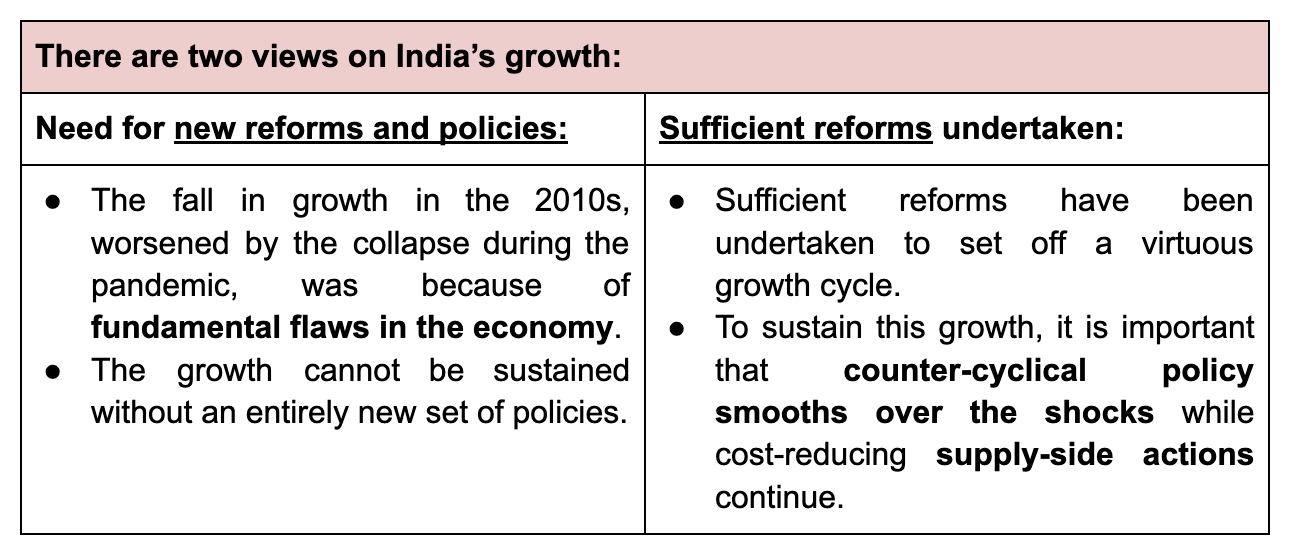

Growth for the fourth year after COVID-19, contained inflation and poverty reduction suggests that sufficient reforms have been undertaken and the Indian economy is on an upward trajectory.

Impact of Inflation on GDP Growth:

- It is argued that a lower inflation measure overestimates growth.

- If the low Wholesale Price Index (WPI) overestimates growth, then high WPI inflation should underestimate growth.

- WPI inflation was in double digits for two years between April 2021 and March 2023.

- According to this logic, the average post-pandemic GDP growth over 2021-24, measured at 8.1 percent, should be even higher.

- A lower inflation does not necessarily mean that the growth has been underestimated.

|

Wholesale Price Index (WPI):

|

Absence of double deflation:

- India, along with other major countries, does not yet have a services price index.

- The use of double deflation can either under- or over-estimate GDP.

- Double deflation is the technique used to estimate the real value added by an industry.

- In the double deflation method, real value added is measured as the difference between real gross output and real intermediate inputs.

Data accuracy:

- Data in India is often subject to “smell tests”, highlighting any evidence that can be found to question the veracity of growth measurement.

- So much high-frequency data, not subject to problems in the measurement of aggregates, is available now.

- All of the available indicators show strong economic activity in the country.

Did India do better than expected because global growth was higher?

- India did not do well in 2019 despite good global growth.

- Appropriate domestic policy is essential for the growth of the economy and global growth will not always boost the Indian economy.

Fall in household financial savings:

- Households include informal enterprises and they are borrowing to invest.

- Liabilities are rising to finance investment more than consumption.

- This is healthier and more sustainable, unlike the borrowing-financed consumption binge of the 2010s.

- Moreover, the current account deficit has fallen below 1% of GDP, partly because financial savings are better intermediated and available for domestic investment.

Conclusion:

- There is healthy investment and credit-led growth supported by a strong financial sector that will raise savings as incomes rise.

- India’s private credit ratios are much below its peers.

- The view that private investment is not rising is because of an expectation of a 2008-type infrastructure boom that turned out to be unsustainable.

- This will not happen under better bank independence, regulation and risk-based pricing today.

- Gross capital formation was 32.2% of GDP in 2022-23.

- This is not low and is mostly contributed by private capex (capital expenditure), which is rising sustainably in a virtuous cycle that will become clearer after the elections. Policy continuity is important for private capex.

- Centre for Monitoring Indian Economy (CMIE) data shows new private sector projects in Q4 2023-24 were at Rs 9.8 trillion — the second-highest level ever.