GS Paper III

News Excerpt:

Restrictions imposed by the central government on the export of rice, wheat, sugar, and onions have impacted India's agricultural exports in the fiscal year that just ended, following a remarkable performance in 2022-23.

More About the News:

- In the fiscal year ending on March 31, 2024, India's agricultural exports saw a decline of 8.2%, attributed to restrictions on various commodities such as cereals, sugar, and onions.

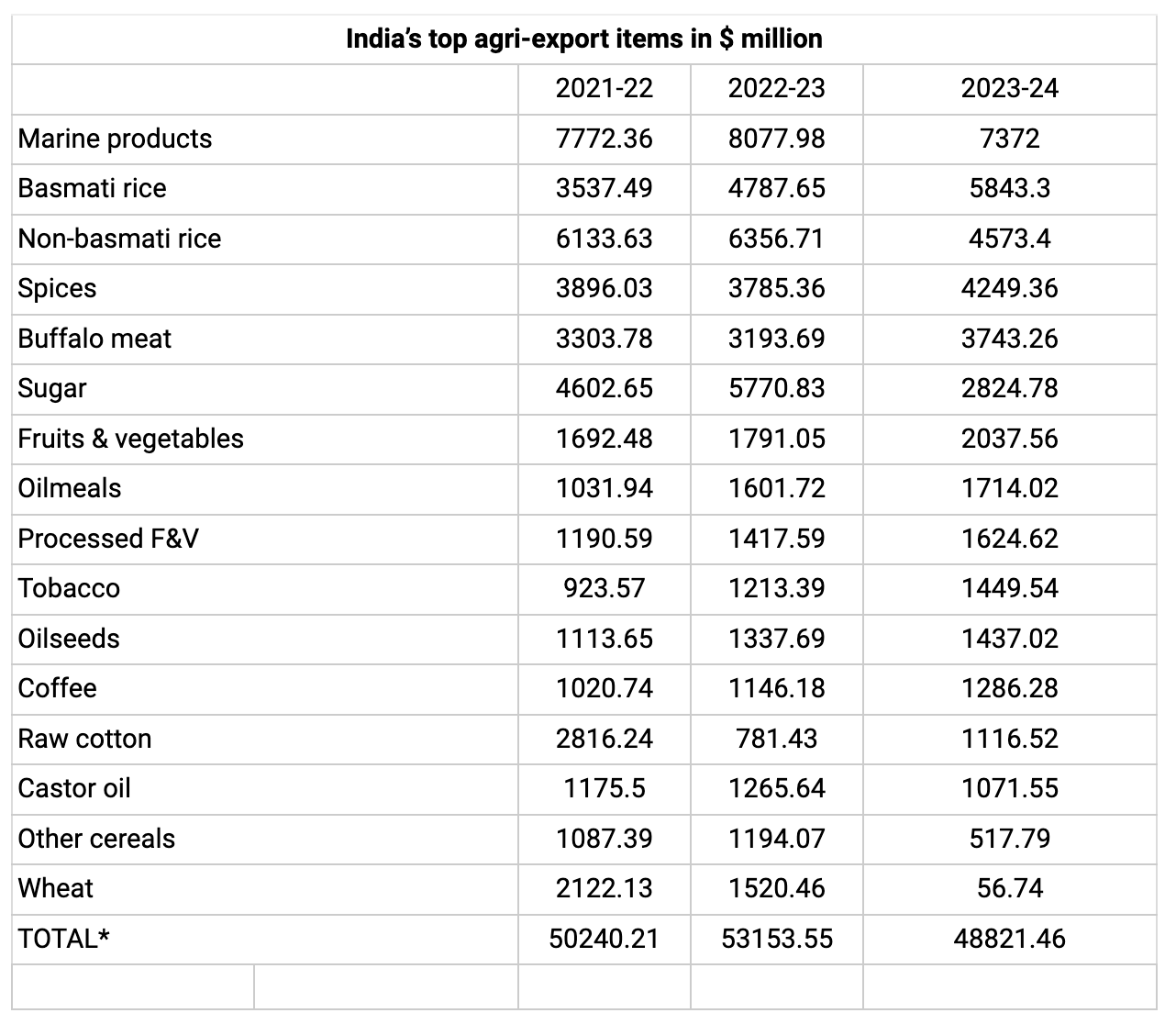

- According to data from the Department of Commerce, the total value of farm exports was $48.82 billion, down from the record $53.15 billion in 2022-23 and $50.24 billion in the previous fiscal year.

- During the initial years of the NDA government, agricultural exports experienced a decline from $43.25 billion in 2013-14 to $35.60 billion in 2019-20, while imports rose from $15.53 billion to $21.86 billion.

- This trend was largely due to a decline in global agricultural commodity prices, as indicated by the UN Food and Agriculture Organization's (FAO) food price index dropping from an average of 119.1 to 96.5 points between 2013-14 and 2019-20. The decrease in international prices made India's exports less competitive while increasing vulnerability to imports.

- However, the global price recovery following the Covid-19 pandemic and Russia's invasion of Ukraine led to a surge in India's agricultural exports and imports to all-time highs in 2022-23, with the FAO index reaching 140.8. These figures then declined in the most recent fiscal year.

Drivers of Export:

- Current Decline: Export declines, notably in sugar and non-basmati rice, were significant contributors to the overall decrease, driven by governmental restrictions. During the current production year starting from October 2023, no sugar exports were permitted, resulting in a decrease to $2.82 billion in 2023-24 from previous highs of $5.77 billion and $4.60 billion.

- Domestic Reasons: Similarly, concerns regarding domestic availability and food inflation prompted a ban on white non-basmati rice exports since July 2023. Currently, only parboiled grain shipments are allowed within this segment, subject to a 20% duty. Consequently, non-basmati exports dropped from a record $6.36 billion in 2022-23 to $4.57 billion in 2023-24.

- Wheat & Onion: Wheat and onion exports also faced restrictions due to domestic shortages and rising prices. Wheat exports ceased entirely in May 2022, resulting in a decrease to $56.74 million in 2023-24 from a peak of $2.12 billion.

- Meanwhile, the ban on onion exports was lifted on May 4, with a floor price of $550 per tonne and a 40% duty imposed. Despite these changes, onion exports declined to 17.08 lakh tonnes ($467.83 million) from 25.25 lakh tonnes ($561.38 million) in 2022-23.

- Other Items: While most other major agricultural export items experienced growth, a few, such as buffalo meat, oil meals, and raw cotton, fell short of their previous record levels achieved in earlier years. Basmati rice exports reached $5.84 billion in 2023-24, surpassing the previous high of $4.86 billion in 2013-14, while spices exports crossed the $4 billion mark for the first time.

Drivers of Import:

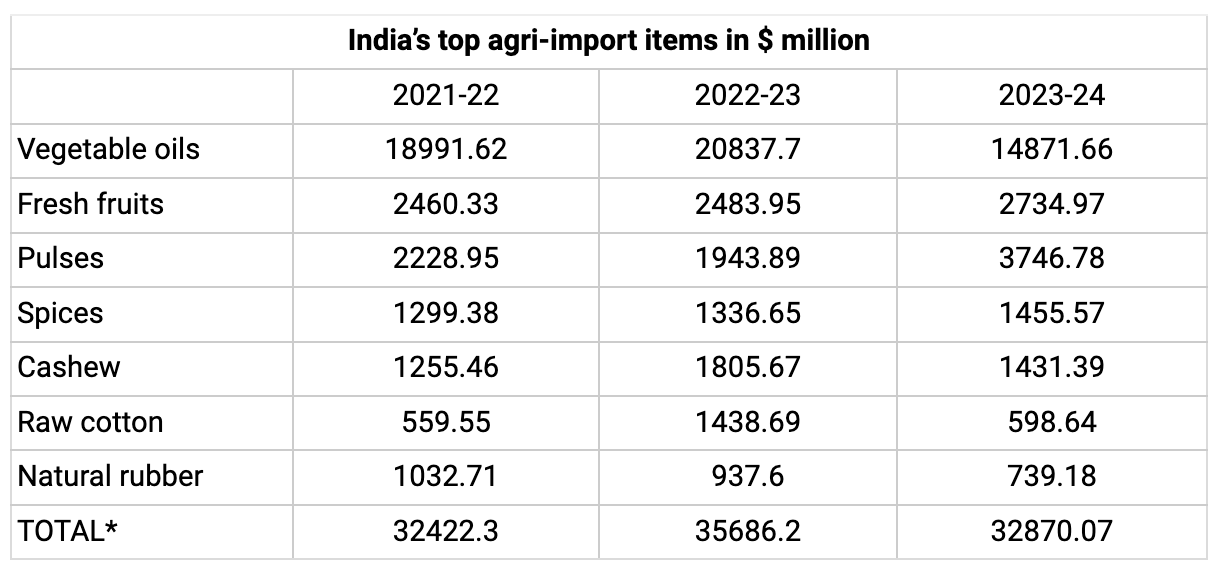

- Trend: The notable trend in imports is a 7.9% decrease in overall agricultural imports during the fiscal year 2023-24, primarily attributed to a significant decline in imports of edible oils.

- Vegetable Oil: In 2022-23, India's imports of vegetable fats exceeded $20 billion, coinciding with the aftermath of the Russia-Ukraine conflict when the FAO index and the vegetable oil sub-index averaged 140.8 points and 168.5 points respectively.

- However, in 2023-24, the average FAO index dropped to 121.6 points and the vegetable oil sub-index to 123.4 points, resulting in lower global prices and reducing the vegetable oil import bill to below $15 billion for the fiscal year.

- Despite the decrease in spending on cooking oil imports, imports of pulses nearly doubled to $3.75 billion in 2023-24, reaching levels not seen since 2015-16 and 2016-17 when they were at $3.90 billion and $4.24 billion respectively.

Policy Takeways:

- Farmers and agricultural traders, much like any other business operators, seek stability and predictability in policies.

- Example: Consider onion farmers, for instance, who typically yield around 10 tonnes per acre. A decrease of Rs 5/kg in their earnings translates to a revenue loss of Rs 50,000 for their produce. Conversely, for a household consuming 5-6 kg of onions monthly, a Rs 5/kg price increase results in an additional expenditure of only Rs 25-30.

- When governments opt to ban or restrict agricultural exports, including products like de-oiled rice bran, which is a byproduct of paddy milling used in animal feed, they typically prioritize consumer interests over those of producers. Such measures can have a more significant impact when implemented suddenly, as seen with the abrupt ban on wheat exports.

- Establishing export markets requires considerable time and effort. Many economists advocate for a more predictable and rules-based approach to policy-making. For example, they suggest implementing temporary tariffs instead of outright bans or quantitative restrictions.

- Similarly, the approach to imports also warrants attention. The Union government has eliminated import duties on most pulses and maintained a 5.5% duty on crude palm, soybean, and sunflower oil.

- However, these minimal tariffs contradict the government's goal of promoting crop diversification, aiming to shift farmers away from water-intensive crops like rice, wheat, and sugarcane towards pulses and oilseeds, which are also significantly imported.

Conclusion:

As the new government assumes office post-elections, there may be a need for a more rationalized export-import policy that balances the interests of producers and consumers, as well as aligns with both short- and long-term objectives for the agricultural sector.