GS Paper III

News Excerpt:

UN Trade and Development (UNCTAD) released the World Investment Report for 2024.

Key points of Report

- Global foreign direct investment (FDI) decreased by 2% to $1.3 trillion in 2023 due to an economic slowdown and rising geopolitical tensions.

-

However, the report notes that excluding large investment flow fluctuations in certain European conduit economies, the decline surpasses 10%.

FDI Trend in India

-

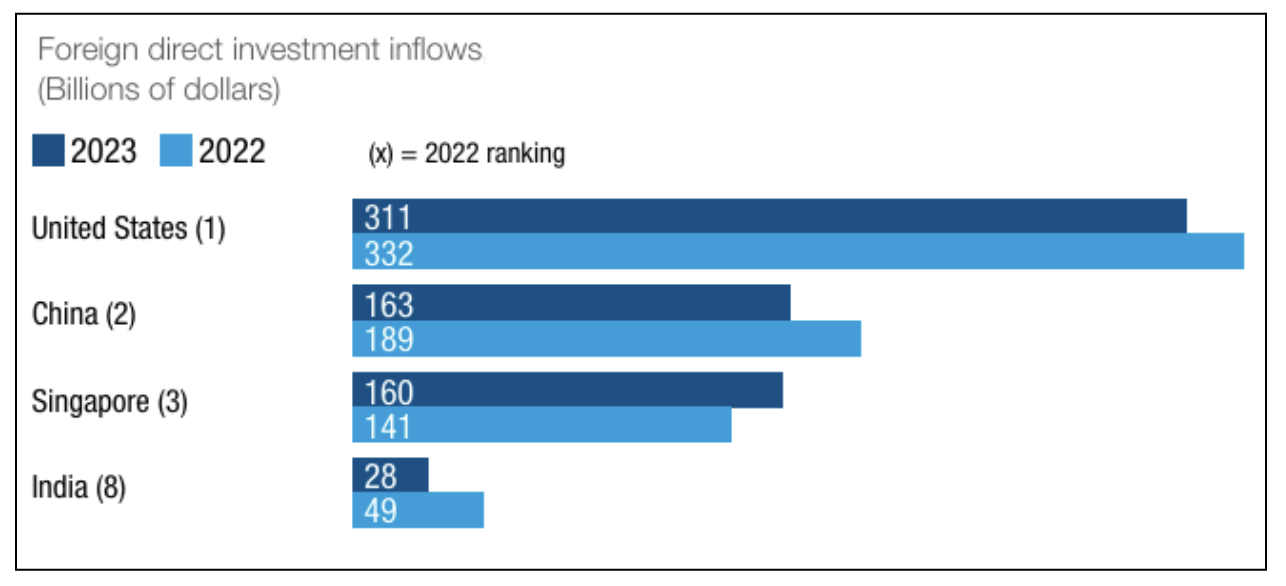

India fell seven spots in the global foreign direct investment (FDI) ranking to 15 as inflows declined 43% to $28 billion in 2023. The country saw FDI inflows worth $49 billion in 2022.

- Net foreign direct investment (FDI) in India, which is the difference between inflows and outflows, plummeted by 62.14% to $10.6 billion in the financial year ending March 31, 2024 (FY24), from $28 billion the previous year, according to Reserve Bank of India (RBI).

- This marks the lowest level of net FDI since 2007, largely due to increased repatriation of capital.

Regional Trends

- Developing Countries: FDI to developing countries fell by 7% to $867 billion.

- Africa: FDI fell by 3% to $53 billion, but there were some significant new projects like a green hydrogen project in Mauritania.

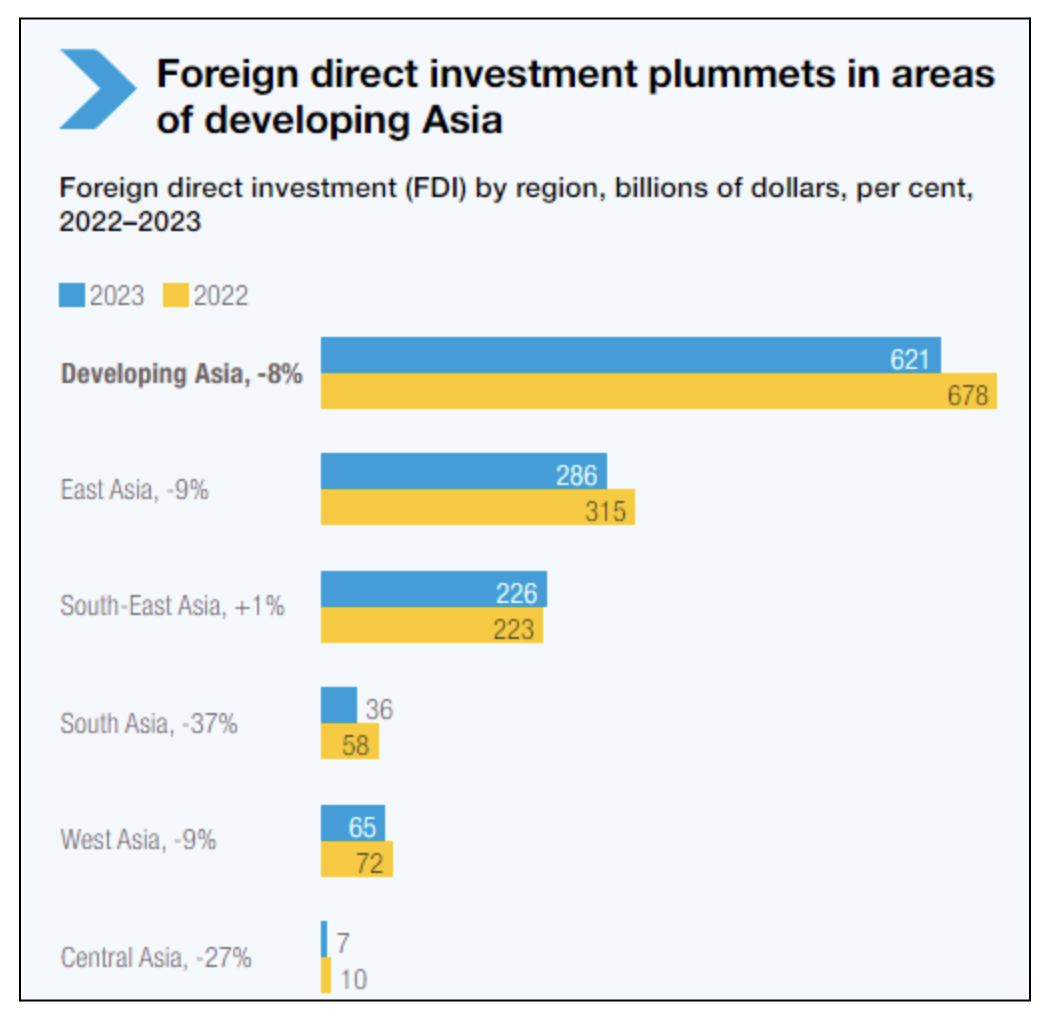

- Asia: Investment dropped by 8% to $621 billion, with significant declines in China, India, and West and Central Asia, while South-East Asia remained stable.

- Infrastructure investment: Tight financing conditions led to a 26% fall in international project finance deals, critical for infrastructure investment.

- China: China is the world's second-largest FDI recipient, experiencing an unusual drop.

- India: Sizeable declines were recorded in India and in West and Central Asia.

Reasons for Declining FDI Trend

-

Crises, protectionist policies, and regional realignments are disrupting the global economy, fragmenting trade networks, regulatory environments, and global supply chains.

-

This fragmentation undermines the stability and predictability of global investment flows, creating both obstacles and isolated opportunities.

Future Prospects

- Despite the challenges, modest growth in FDI for 2024 is possible due to easing financial conditions and efforts to facilitate investment.

- Some sectors, like automotive and electronics manufacturing, are seeing growth, especially in regions with good market access.

- However, many developing countries struggle to attract investment and join global production networks.

Impact on Sustainable Development Goals

-

The decrease in project finance negatively impacted sustainable development, with new funding for Sustainable Development Goals (SDGs) sectors dropping by over 10%, especially in agrifood and water.

- Agrifood systems and water and sanitation had fewer projects in 2023 than in 2015.

- Tight financing conditions in 2023 led to a 26% drop in international project finance, crucial for infrastructure in areas like power and renewable energy.

- Sustainable bonds showed slight growth in 2023, while investment in sustainable funds fell by 60%.

- Concerns about greenwashing (misleading sustainability claims) are making investors cautious.

- Policy actions are needed to prevent backlash against sustainable investment strategies.

International Investment Agreements

- In 2023, 29 new international investment agreements were made, fewer than half being traditional bilateral treaties.

- Reforming older agreements is slow, with about half of global FDI still governed by unreformed treaties, increasing legal disputes, especially in developing countries.

Digital Government

- The report advocates for a bottom-up approach to digital government development, starting with basic business services and gradually expanding.

- Since 2016, online single windows in developing countries have increased from 13 to 67, and in developed countries from 12 to 28.

- Information portals for business and investor registration also expanded significantly.

Way Forward:

-

The report suggests that business facilitation and digital government solutions can boost investment by creating a transparent and efficient environment.

- It suggests a gradual approach to implementing digital government services, starting with basic business services and expanding to more areas.

- Investment facilitation aims to simplify processes for investors through better access to information, transparency, and streamlined administrative procedures.