Supreme Court’s decision on tax treaties

Relevance: GS-III:

- Prelims: Section 90 of the IT Act; Most Favored Nation; Income Tax Act 1961; Double Taxation Avoidance Agreement;

- Mains: Effects of liberalization on the economy, changes in industrial policy, and their effects on industrial growth.

Why in the News?

The Hon'ble Supreme Court delivered its judgment in the ‘Most Favored Nation (MFN)’ Clause controversy that has repercussions on Multi-National Companies across the board due to the principles enunciated in India's treaty practice.

Background:

- In India, treaty-making is neither wholly an Executive Power nor wholly a Legislative Act. Treaty-making involves both these Constitutional organs and Non-constitutional organs, especially when it can impact or interfere with Municipal Laws or the Rights of its people.

- This Judgment is one that shows cases an approach, which is a timely and meaningful interpretation of International Treaties.

- This Judgment is an indication of the Nation’s arrival into this Think Tank of Trade and Business Ideologies of the Future World and will act as a bridge to connect both ends of the world allowing free, fair, and reasonable flow of trade and commerce to the mutual benefit of one and all.

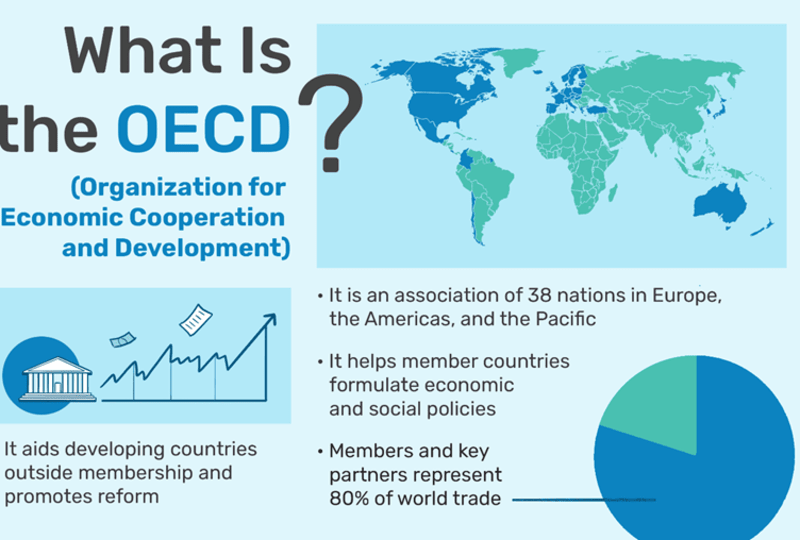

Trade without discrimination:Most-favored-nation (MFN):

What is the Most Favored Nation Clause in Indian Tax treaties?

|

- The SC has examined the MFN clauses with respect to Netherlands-India, France-India, and Switzerland treaties. It primarily clarified points related to

- The need for a notification u/s. 90(1) of the Income Tax Act 1961 (the Act) for availing the benefit of MFN and to give effect to the treaty by changing the terms and conditions that alter the existing provisions of the law.

- The relevant date for another state to be a member of the OECD.

- MFN clauses are not uncommon in tax treaties, through this clause one State A obligates to the other treaty partner State B, that it would offer the same treatment (more favorable) than what is agreed in the treaty, if any other State C is offered more favorable treatment in another treaty, both State B and State C being OECD members.

- The intention is that all OECD members be given similar treatment in their treaties with the same state, something like an anti-discrimination clause. Such favorable treatment could be of withholding tax rates, scope of income, definitions or any other nature.

| BEYOND EDITORIAL: Supreme Court’s Ruling: Hon’ble Supreme Court came to the following conclusion:

While coming to the above conclusions, the Hon’ble Supreme Court made the following observations:

|

What is a Double Taxation Avoidance Agreement (DTAA)?

- DTAA is essential to avoid multiple levels of taxation on the same income, as well as to provide a certain degree of certainty to non-resident taxpayers.

- DTAAs entered into by India with certain developed economies, in addition to providing tax concessions; contain a Most Favored Nation (MFN) clause, which enables the residents of such countries to enjoy any additional benefit extended to any third country.

- Such MFN clauses have been existing in treaties entered into by India, for more than 40 years.

Indian and DTAA:

- India has a vast network of DTAAs with other countries under Section 90 of the Income Tax Act, of 1961. Currently, India has established 94 comprehensive DTAAs and eight limited DTAAs.

- While comprehensive agreements address all sources of income, the scope of limited agreements is, as indicated, limited to specific sources.

- A DTAA between India and other countries is drafted on a reciprocal basis and covers only residents of India and the residents of the negotiating country.

- Any person or company that is not resident, either in India or in another country that has entered into an agreement with India, cannot claim benefits under the signed DTAA.

What will be the consequences of this judgment?

- Far-reaching impact across industries: Considering the benefits from the MFN clause, this ruling would have a far-reaching impact across industries on all the past decisions for example, the third state that was a member of the OECD at the time of applying the benefit.

- Impact on the Incomes: This will have an impact on all streams of income such as dividends, royalties, fees for technical services, and interest to which the MFN clause is applicable – be it applying beneficial scope or beneficial tax rate.

- It may be noted that the Supreme Court’s decision is in line with the CBDT’s Circular of 2022 wherein one of the conditions for availing DTAA benefits under the MFN route was that the second country should have been notified.

- Difficulty in availing benefits: Currently, as India has not notified any country for the purpose of the MFN Clause, availing benefits under the MFN clause will be difficult.

- Detagged/Unresolved issues: It may be pertinent to note that the Supreme Court has specifically excluded interpretation of the matter involving India-Spain DTAA and detagged it. Thus, one needs to analyze the applicability of this decision to the MFN clause under India-Spain DTAA.

Way Forward:

DTAA aims to promote cross-border trade and investment by providing a predictable and stable tax environment. By clarifying the taxation rules and providing incentives to investors, it will encourage Global economic cooperation between the countries. We need to ensure fairness and equity in the international tax system.

PYQs

Mains:

Q1). Comment on the important changes introduced in respect of the Long term Capital Gains Tax (LCGT) and Dividend Distribution Tax (DDT) in the Union Budget for 2018-2019. (2018)

Prelims:

Q1). With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct? (2018)

- It is introduced as a part of Income Tax Act.

- Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the codes given below:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2