Time to 'phase up' on oil production

Relevance: GS III (Economy and Environment)

- Prelims: Geopolitical conditions affecting the Indian Economy; Biofuels programmes by the Government;

- Mains: Energy Security; Biofuels; Government initiatives for clean energy; Geopolitical conditions affecting Indian Economy;

Why in news?

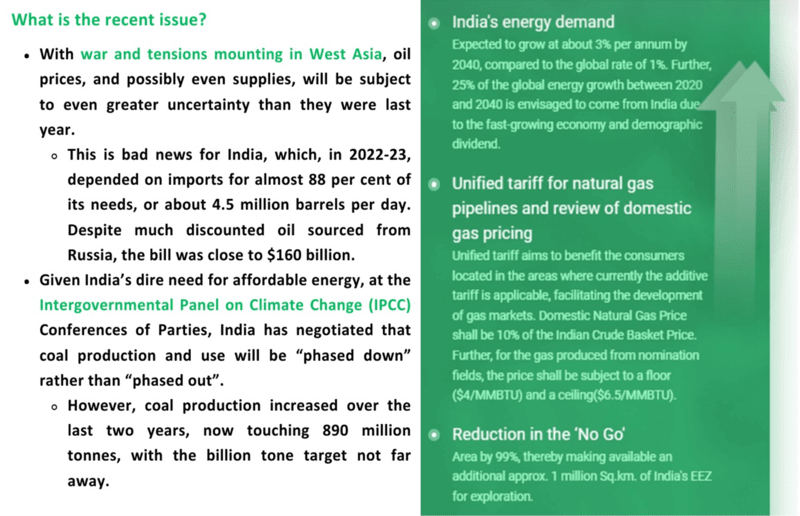

Under the current global geopolitical conditions, India’s energy security concerns are currently high. As the demand for petroleum products drives up relentlessly, imports have surged to 230 mt, leaving the Indian market vulnerable to the vagaries of global uncertainties.

|

About Intergovernmental Panel on Climate Change:

|

India’s Oil and Energy Potential:

- Exploration & Production:

- There are 26 sedimentary basins, covering a total area of 3.4 mn square km. The area is spread across the land, with shallow water up to 400-meter water depth, and Deepwater further up to the Exclusive Economic Zone (EEZ).

- Cumulative crude oil production during FY 21-22 was 29.7 MMT. Natural Gas production for FY 21-22 was 34.024 BCM, which is intended to increase the nation's exploration acreage by 0.5 mn sq. km. by 2025 and by 1.0 mn sq. km. by 2030.

- Refinery:

- India‘s refining capacity stands at 251 MMTPA as of October 2022, comprising 23 refineries. Refinery capacity utilization is about 96% for the year 2021-22. Indian Oil Corporation (IOC) is the largest domestic refiner with a capacity of 70.1 MMTPA.

- India aims to increase its refining capacity to 450 MMTPA by 2030.

- Natural Gas Infrastructure:

- A total of 22,335 km of the natural gas pipeline is operational and about 12,995 km of the gas pipeline is under construction as of December 2022.

- Target to increase the pipeline coverage by 54% to 34,500 km by 2024-25 and to connect all the states with the trunk natural gas pipeline network by 2027.

- Liquefied Natural Gas (LNG) supply is forging ahead on both coasts with 06 operational LNG terminals. The total capacity of LNG terminals stands at 42.7 MMTPA.

|

Union Budget 2023 Highlights

|

What are the limitations behind the tensions mounting oil sector in India?

- Continuous negative growth of Oil Production in India: In evidence since 2012-13, continued in 2022-23, with domestic oil production falling again, to 29.2 million tons (mt), down about 25 per cent from the 38 mt achieved in 2011-12. As the demand for petroleum products drives on relentlessly, imports surged to 230 mt, leaving us vulnerable to the vagaries of global uncertainties. The possibility of the war in Gaza spilling over into the Gulf region is just one of them.

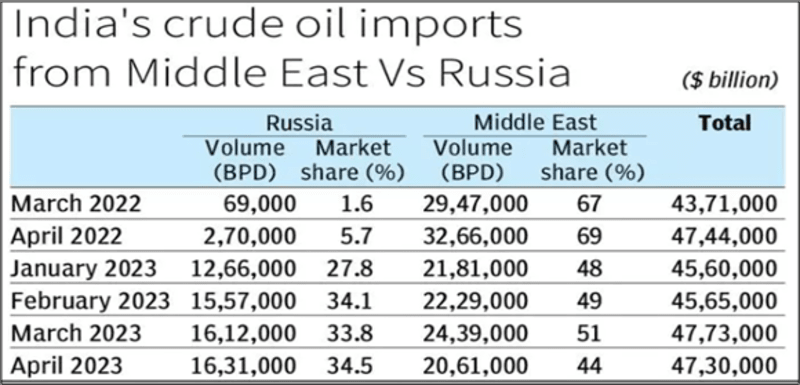

India’s discomfort with using the “Yuan” to pay for Russian oil:

- The “Yuan” is now the third most used currency for trade financing, while the rupee doesn’t circulate much internationally. Because the rupee “exchange rate is volatile”, causing a sharp shrinkage in profits for the Russians. (India’s current account deficit was also one of the causes of the volatility).

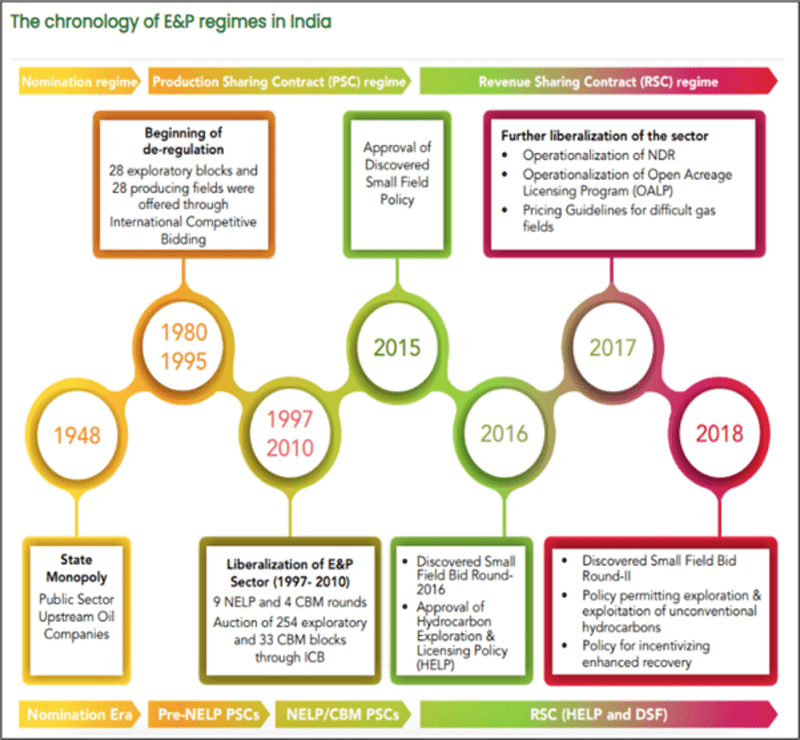

- Our oil problems have mounted despite the Ministry of Petroleum and Natural Gas (MoPNG) having driven very substantial reforms since the Hydrocarbon Exploration and Production Policy (HELP) was adopted in 2016.

|

Good case studies: Smaller countries like Guyana, Namibia, and Mozambique, all of which once had geological prospects as (allegedly) poor as India’s, have received multiples of our figures in investment, and are on the way to becoming major players in the global hydrocarbon industry. |

- Issue in implementation of programs and policies: As cited in a recent publication on the nine-year achievements of the ministry, reforms have accelerated in the last few years. Yet the $3 billion investment commitments, as mentioned in the MoPNG’s achievements, are nowhere considering that the global oil industry invests $500 billion in Exploration and Production annually.

- Governance and Technical Issues in the Oil Sector: The real problem in India is that the domestic oil sector remains probably the most overtaxed, over-regulated, and over-litigated part of the industrial economy. Former leaders of India’s oil sector privately confirm that foreign and Indian companies which invested both money and hope in India after the HELP, etc came into force are still ground down by high taxes and endless litigation.

- The conclusion is that the Government of India, led by the Ministry of Finance, views the oil producers purely from the lens of revenue maximization; and oil-industry regulators operate on the basis of suspicion rather than facilitation of these vital players in the national economy.

Way Ahead:

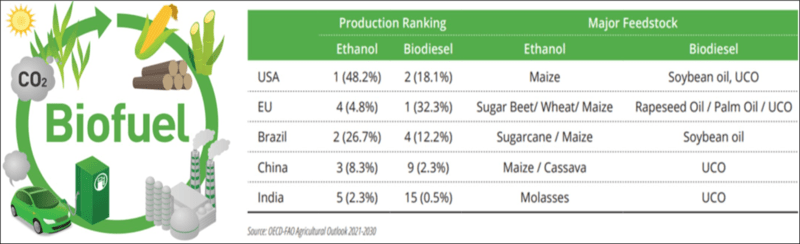

- Agricultural Residue as Silver Linings: According to the Technology Information, Forecasting and Assessment Council’s (TIFAC) 2018 report, Rice straw, rice husk, wheat straw, sugarcane tops and bagasse account for almost 80% of the residue generated by the crops. Currently, the available commercial technologies can yield 250 Liters of ethanol from one ton of agriculture residue. However, with plans to go for 20% ethanol blending, it will require necessary modifications in the vehicle engine parts and progressively lean towards “flex-fuel” engines.

- Enhancing Bio-fuel production: India’s present approach to bio-fuel production presents the following key challenges for feedstocks from a lifecycle perspective which need to be accordingly addressed:

- The low yield for sugarcane and maize in India will require land use change, which necessitates the exploration of new production pathways.

- The agricultural sector receives subsidies for inputs and power in addition to MSP, leading to unsustainable water use and fertilizers. Thus, it is necessary to explore less water-intensive agriculture methodologies, more so for sugarcane cultivation and sustained long-term ESG compliances.

- Need to change the viewpoint during governance and regulations: Considerations of national energy security, kick-starting a sizable new investment cycle, or large-scale employment possibilities need to be taken into the calculations. For example, Guyana’s GDP growth last year was over 50 per cent due to this change!

- Learning from other countries: The US, which claims to be a green champion, is now the world’s largest oil producer, and oil and gas are its top export items. The UK too has changed track and is planning to license new oil exploration. China is drilling 10 km underground in Xinjiang to tap ultra-deep oil reserves. There are lessons to be learnt from the experience of the real world supporting the fact of energy transition.

According to the International Energy Agency, by 2027 India will replace China as the fastest-growing importer of additional oil. India is emerging as a world leader in alternative and green sources of energy. But in almost any scenario of energy transition, even in 2040, we will still be consuming more oil and gas than we do today.

BEYOND EDITORIAL:

Government Initiatives towards adopting better policy and its evolution:

In a major policy drive to give a boost to the petroleum and hydrocarbon sector, the Government has unveiled a series of initiatives. The reforms in the hydrocarbon sector are based on the guiding principles of enhancing domestic oil and gas production, increasing investment, generating sizable employment, enhancing transparency and reducing administrative discretion.

- Policy Framework for Early Monetization of CBM

- Discovered Small Field (DSF) Policy and Reform Initiatives to enhance Domestic Production

- Hydrocarbon Exploration and Licensing Policy (HELP) coupled with operationalisation of Open Acreage Licensing Policy (OALP)

- Permission of Extraction of CBM to Coal India Limited (CIL) & its subsidiaries in the Coal Mining area.

- Policy for the Grant of extensions to Pre-NELP Discovered fields and Exploration Blocks Hydrocarbon Vision 2030 for North East

- National Seismic Programme of Un-appraised Areas

- National Data Repository (NDR)

- Policy framework to permit exploration and exploitation of unconventional hydrocarbons in existing acreage of Production Sharing Contracts (PSCs), CBM contracts and Nomination fields

- Policy framework for streamlining the working of PSCs

- Policy framework to incentivize enhanced recovery methods for oil and gas

- As per India Hydrocarbon Vision 2025, 100% Indian sedimentary area is to be appraised. The land area covers 1.63 Million Square Kilometres (48.5%) and the Offshore area covers 1.73 Million Square Kilometres.

- As of now, only 48% of the basinal areas have been appraised. About 4% sedimentary basinal area has been declared as a "NO GO area" by the Ministry of Defence / Ministry of Environment & Forest which remains unapprised.

- This means, about half of the Indian sedimentary basins have the undiscovered potential of hydrocarbons.

PYQs

Mains:

- Each year a large amount of plant material, cellulose, is deposited on the surface of Planet Earth. What are the natural processes this cellulose undergoes before yielding carbon dioxide, water and other end products? (2022)

- Discuss the multi-dimensional implications of uneven distribution of mineral oil in the world (2021)

- Petroleum refineries are not necessarily located nearer to crude oil producing areas, particularly in many of the developing countries. Explain its implications. (2017)

Prelims:

Q1. With reference to ‘palm oil’, consider the following statements: (2021)

- The palm oil tree is native to Southeast Asia.

- The palm oil is a raw material for some industries producing lipstick and perfumes.

- The palm oil can be used to produce biodiesel.

Which of the following statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, and 3

Q2. In the context of global oil prices “Brent crude oil” is frequently referred to in news. What does this term imply? (2011)

- It is a major source classification of crude oil.

- It is sourced from North Sea.

- It does not contain sulphur.

Which of the statements given above is/are correct?

(a) 2 only

(b) 1 and 2 only

(c) 1 and 3 only

(d) 1, 2, and 3